WHY DEFER

Why Defer Contingency Fees?

In the face of rising marginal tax rates, a well-structured fee deferral program can provide a range of advantages, including minimizing your tax liability, accelerating wealth accumulation, improving cash flow, and safeguarding the retention of valuable associates.

REDUCE YOUR TAX BURDEN

Opting for fee deferral offers a dual benefit: you bypass immediate taxation and gain the opportunity to invest the entire fee amount on a tax-deferred basis, allowing your returns to compound over time. Deferring your fee may also present an opportunity to lower your effective tax rate. This can be achieved by spreading your income over time, enabling you to benefit from lower tax brackets at lower annual income levels. Alternatively, you can postpone withdrawing funds until federal tax rates decrease, or you relocate to a state with lower taxes.

GREATER INVESTMENT FLEXIBILITY

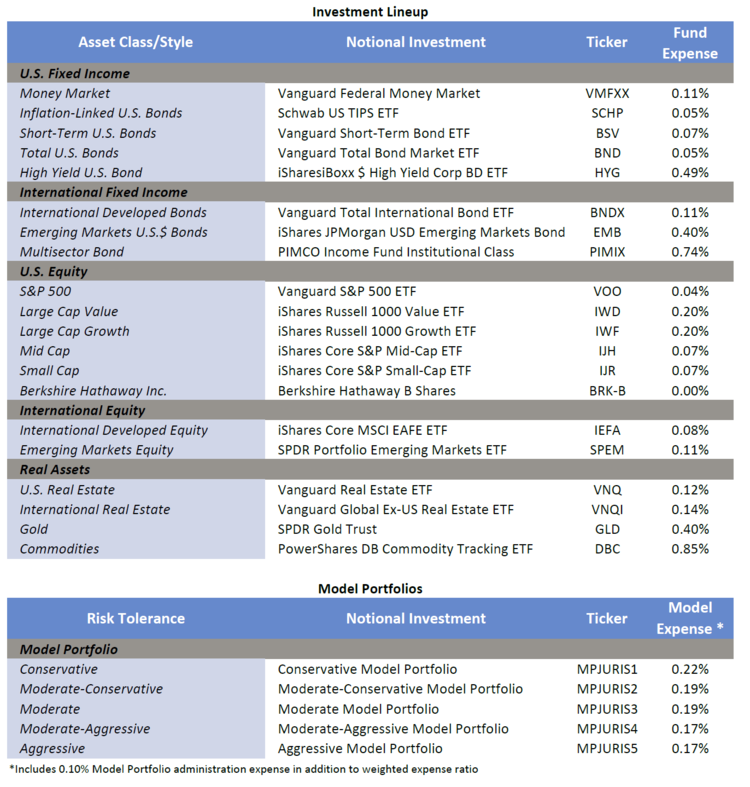

Craft your personalized investment portfolio by selecting from a wide range of low-cost index funds (ETFs) offered by industry giants like Vanguard, Barclays, and BlackRock. Index funds provide superior diversification and lower fees compared to traditional actively managed funds. If you’re unsure how to invest your deferred fees, JurisPrudent’s Model Portfolios offer a straightforward approach to selecting a portfolio aligned with your risk tolerance.

INCREASE YOUR PAYMENT FLEXIBILITY

Like Fortune 500 executives deferring their compensation, you can exercise greater control over the timing of your deferred payments and resulting taxation. By having greater payment flexibility, you can plan better for your financial future.

IMPROVED PAYMENT FLEXIBILITY

Would you like to have better control over the timing of income, and the resulting taxation? Just like top executives deferring their compensation, you can choose to roll your payments forward until you are ready to start receiving them.

Let’s take an example. Say in 2024 you want to defer $1 million. To maximize your liquidity, you can split the $1 million (plus earnings) into 20 quarterly payment buckets over 5 years. Thirteen months prior to any scheduled payment bucket, you may elect to withdraw it. However, if you don’t need the payment as scheduled, the payment bucket will automatically roll forward 5 years to the end of the quarterly payment stream.

By laddering the payments this way, you can effectively manage your cash-flow and better plan for your financial future.

Build a Better Law Firm

Keep your key associates and employees working for you! With the JurisPrudent program, you can customize a bonus retention program for your very best associates and employees. This is a great way to mitigate the risks associated with key people leaving the firm and taking valuable cases with them.